Accounting for Hand Written Checks to Accounts Payable

To account for checks that you write by hand for AP Invoices, you will enter a payment to AP Invoices. This routine works exactly like the routine for entering payments to Receivables (Enter Payments from Owners).

TUTORIAL SCENARIO

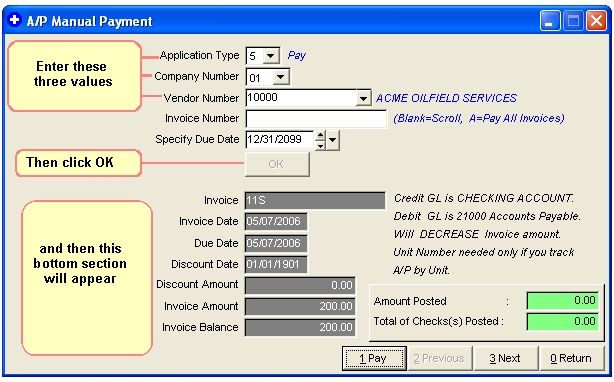

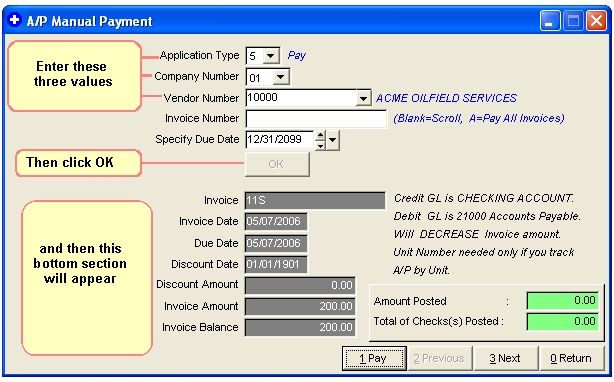

From the Drop Down Menu, select A/P - Invoices - Payments and JE’s

After entering values for Application Type, Company Number, and Vendor Number click OK. The bottom section of the above image will then appear.

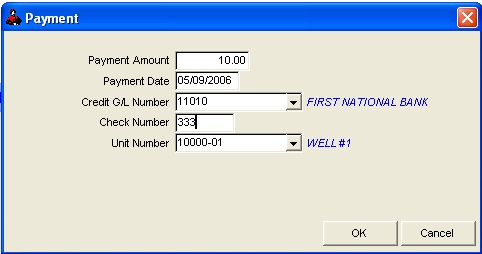

Click Pay.

For the Tutorial, complete as above - don't pay All of the Invoice, because we want to use the invoice again in the next section, when we Print AP Computer Checks.

Note: GL Number 21000 is hard coded for Accounts Payable. Roughneck will make an automatic Dedit to that GL Number for Accounts Payable checks. See GL Number Restrictions.

After completing the fields, click OK.

Then Click Return, then Exit.

You are finished.

Reports To Verify for Checks

A/P Inquiry Report - should show the payment listed below the Invoice. The Invoice Balance should be reduced by the amount of the payment.

Monthly Transaction Listing Report - should show a debit to Accounts Payable (G/L Number 21000) and a credit to the Cash Account you specified. Note: GL Number 21000 is hard coded into the system for Accounts Payable.

Check Listing Report from the Transaction program should show a list of hand written checks if you posted against the cash account.

Related Topics

Accounting for Dummies ~ GL Number Restrictions

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.